car insurance

-

Is It Safe to Drive a Compact Car?

Thinking of buying a compact car? Compact cars are popular for their affordability, fuel efficiency, and maneuverability, especially in urban environments. However, one common concern among drivers is whether compact cars are as safe as larger vehicles. The answer depends on multiple factors, including crash safety ratings, modern safety features, and driving conditions. Compact Car – Crash Safety and Size Considerations One of the main safety concerns with compact cars is their smaller size and lighter weight. In collisions with larger vehicles, compact cars may be disadvantaged due to physics—larger vehicles typically absorb impact better and provide more crumple space. However, modern compact cars have significantly improved in crashworthiness. Many…

-

Car fires – Does car insurance cover them?

Car fires are rare but devastating, causing significant damage or total loss. If your car catches fire, you may wonder whether your car insurance will cover the damage. The answer depends on the type of insurance coverage you have and the cause of the fire. Car Fires And Care Insurance Comprehensive Coverage If you have comprehensive insurance, your car is covered against fire damage, regardless of how the fire started. Comprehensive insurance is optional but is typically required if you have a loan or lease on your car. It covers a variety of non-collision incidents, including theft, vandalism, natural disasters, and fires. Collision Coverage Collision insurance covers damages to your…

-

5 Factors That Influence the Cost of Car Repairs

Car repairs are one of those unavoidable expenses that can catch you off guard. Whether it’s a minor fender bender or a more serious accident, the cost to fix your vehicle can vary widely. So, what actually determines how much you’ll pay when your car is in the shop? Here are five key factors that impact the cost of car repairs: 1. Make and Model of the Vehicle One of the biggest determinants is the type of car you drive. Luxury brands like BMW, Audi, and Mercedes-Benz tend to have higher repair costs because they often require specialized parts and expert technicians. Even within the same brand, newer or more…

-

Does Car Insurance Cover Scratches and Dents? Learn More Here!

Scratches and dents are unfortunate for car owners, whether caused by minor accidents, shopping carts, or even acts of vandalism. But does car insurance cover these types of damages? The answer depends on your policy and how the damage occurred. Comprehensive and Collision Coverage If you have comprehensive or collision coverage, your insurance may cover the repair costs for scratches and dents. Collision coverage applies when the damage is caused by an accident with another vehicle or an object, such as a fence or pole. Comprehensive coverage protects against non-collision incidents like vandalism, falling objects, or weather-related damage. When Insurance Won’t Cover Scratches and Dents If you only have liability…

-

Does Central Oregon Car Insurance Cover Medical Expenses?

Does car insurance also cover medical expenses? This is a top question that every driver has. It’s an essential safeguard for drivers in Central Oregon, but many people are unclear about whether their policy covers medical expenses in the event of an accident. The answer depends on your coverage type, Oregon’s insurance laws, and the specifics of your policy. Understanding these factors can help you make informed decisions about your auto insurance coverage and ensure you’re adequately protected in an accident. Understanding Personal Injury Protection (PIP) in Oregon Oregon is a fault-based state for car accidents, meaning that the driver responsible for the accident is typically required to pay for…

-

How to Know If You’re Overpaying for Central Oregon Car Insurance

Car insurance is essential for every driver, but how can you tell if you’re overpaying? In Central Oregon, where the cost of living and insurance premiums vary, understanding what’s reasonable can save you money while ensuring proper coverage. Compare Rates Frequently Insurance companies evaluate risk differently, leading to varied rates for the same coverage. Use online tools or consult local agents to compare premiums annually. Central Oregon’s unique conditions—such as rural driving, winter weather, and wildlife risks—mean rates might differ significantly from urban areas like Portland. Check Your Coverage Needs Evaluate if your policy includes extras you don’t need. For instance, do you need full coverage on an older car,…

-

January is a great time for new car insurance, here’s why…

The start of a new year often inspires fresh beginnings, prompting people to reevaluate their finances, goals, and plans for the months ahead. Among these considerations, car insurance is frequently overlooked but can be a significant opportunity for savings and improved coverage. Getting a new car insurance quote at the beginning of the year can provide multiple benefits, from financial savings to tailored coverage that better suits your needs. Here are some compelling reasons to consider shopping for a new car insurance quote as you start the new year. Potential for Cost Savings When comparing quotes, consider not only the cost but also the coverage limits, deductibles, and any additional…

-

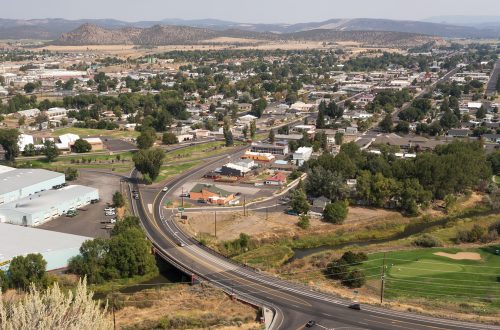

Bend Oregon Car Insurance: Everything You Need to Know

Searching for Bend Oregon Car insurance information? For those residing in Bend, Oregon, or planning to relocate, understanding car insurance is not just a necessity, but a vital tool for protecting your financial well-being. This guide is your comprehensive resource, covering everything you need to know about car insurance in Bend, from state requirements to tips for finding the best coverage. About Bend Oregon Car Insurance In Oregon, drivers are legally required to carry minimum levels of car insurance. These include: Bodily Injury Liability: $25,000 per person and $50,000 per accident. Property Damage Liability: $20,000 per accident. Personal Injury Protection (PIP): $15,000 per person. Uninsured/Underinsured Motorist Coverage: $25,000 per person…

-

How Garage Address Influences Car Insurance Prices

Searching for more information on the connection between garage address in Central Oregon. and it’s influences on car insurance prices? The location of where you park your car at night, either in a garage or on the street, does absolutely affect the price that you’re going to pay for your monthly or annual car insurance premium for a wide variety of reasons. In this article, we will share with you the reasons why the reasons why your nightly Central Oregon parking destination does affect what you pay for your car insurance premium. Understanding How Your Garage Or Parking Address Affects Your Car Insurance Premium Insurance companies evaluate the risk associated…

-

Does Car Insurance Cover Car Repairs?

Car insurance is essential for financially protecting yourself in accidents, damage, or theft. However, whether your car insurance covers repairs depends on the type of coverage you have and the circumstances surrounding the need for repairs. Let’s break down the specifics. Understanding Car Insurance Coverage Types Car insurance policies typically include several types of coverage, each designed to address specific risks: Liability Coverage: This is the most basic form of car insurance required in most states. It covers damage or injury you cause to others. However, liability insurance does not cover repairs to your car, regardless of fault. Collision Coverage: This type of insurance is designed to cover the cost…