Bend Oregon Car Insurance: Everything You Need to Know

Searching for Bend Oregon Car insurance information? For those residing in Bend, Oregon, or planning to relocate, understanding car insurance is not just a necessity, but a vital tool for protecting your financial well-being. This guide is your comprehensive resource, covering everything you need to know about car insurance in Bend, from state requirements to tips for finding the best coverage.

About Bend Oregon Car Insurance

In Oregon, drivers are legally required to carry minimum levels of car insurance. These include:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident.

- Property Damage Liability: $20,000 per accident.

- Personal Injury Protection (PIP): $15,000 per person.

- Uninsured/Underinsured Motorist Coverage: $25,000 per person and $50,000 per accident.

These minimums ensure basic coverage but may only be enough for some drivers. Consider higher limits or additional coverage for more excellent protection.

Factors Affecting Car Insurance Rates in Bend

Various factors influence car insurance premiums in Bend:

- Driving Record: Clean records result in lower premiums, while accidents or violations increase rates.

- Vehicle Type: Cars with higher safety ratings often cost less to insure.

- Location: While Bend has relatively low crime rates, areas with higher theft or vandalism rates can raise premiums.

- Mileage: Drivers with shorter commutes typically pay less for insurance.

- Age and Gender: Younger and male drivers often face higher rates due to statistically higher risk levels.

Average Car Insurance Costs in Bend

The average annual car insurance premium in Bend ranges from $1,000 to $1,500, depending on your coverage and personal factors. While this is slightly above Oregon’s state average, Bend’s growing population and unique road conditions contribute to these rates.

Standard Discounts Available in Bend

To reduce your premiums, look for discounts such as:

- Bundling Discounts: Combine car insurance with home or renters insurance.

- Good Driver Discounts: Earn rewards for maintaining a clean driving record.

- Multi-Vehicle Discounts: Insure multiple vehicles under the same policy.

- Good Student Discounts: Available for young drivers with high academic performance.

- Usage-Based Discounts: Programs like telematics track driving habits to reward safe driving.

Unique Driving Considerations in Bend

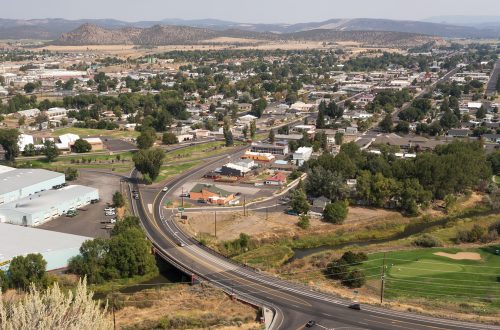

Bend’s scenic beauty and outdoor attractions also come with unique driving challenges. Winter roads can be icy and treacherous, increasing the risk of accidents. Ensure your policy covers collision and comprehensive damage to protect against winter-related incidents.

Moreover, with Bend’s population on the rise, the likelihood of traffic incidents is increasing. It’s crucial to have sufficient liability coverage to shield yourself from potential financial burdens.

Tips for Finding the Best Car Insurance in Bend

- Compare Quotes: Shop around and compare policies from multiple insurers.

- Check Reviews: Look for companies with strong customer satisfaction ratings.

- Assess Your Needs: Choose coverage levels that match your driving habits and risks.

- Work with a Local Agent: Local insurance agents understand Bend-specific risks and can tailor policies accordingly.

- Ask About Add-Ons: Consider roadside assistance or rental car reimbursement for added peace of mind.

Contact Us

Car insurance in Bend, Oregon, is more than just a legal requirement—it’s a crucial safety net for you and your family. By understanding the factors that influence your premiums, exploring available discounts, and choosing the right coverage, you can confidently drive knowing you’re well-protected. Whether navigating the Cascade Lakes Highway or commuting downtown, the right car insurance policy will ensure peace of mind on every journey.

Get an affordable car insurance quote today by calling us at (541) 381-8835 or click here to connect with us online.