How to know when you’re overpaying for car insurance

Determining whether you’re overpaying for car insurance involves assessing various factors and comparing quotes from different providers. Here are some steps to help you evaluate your car insurance costs:

- Shop Around:

- Obtain quotes from multiple insurance providers. Different companies use various criteria to calculate premiums, so rates can vary significantly.

- Compare Coverage:

- Ensure that you compare quotes for the same coverage types and limits. A lower premium might be due to less coverage, so make sure you’re comparing apples to apples.

- Assess Deductibles:

- Higher deductibles often result in lower premiums. Evaluate your deductible and consider whether you can comfortably afford a higher one in case of a claim.

- Review Discounts:

- Check for available discounts. Many insurance companies offer discounts for factors like safe driving records, bundling policies, and anti-theft devices. Make sure you’re taking advantage of all applicable discounts.

- Evaluate Your Coverage Needs:

- Reassess your coverage needs periodically. If you’ve paid off your car or its value has decreased significantly, you may not need as much coverage as before.

- Monitor Your Driving Record:

- A clean driving record can help you qualify for lower rates. If your driving record has improved since you last renewed your policy, inquire about rate adjustments.

- Check for Rate Increases:

- Pay attention to any rate increases during policy renewals. If your premium has gone up without a clear reason, it’s worth questioning your insurance provider about the changes.

- Bundle Policies:

- Many insurance companies offer discounts if you bundle multiple insurance policies (such as auto and home insurance) with them. Consider consolidating your policies with one provider.

- Maintain Good Credit:

- In some regions, insurance companies use credit scores to determine premiums. Maintaining good credit can positively impact your insurance costs.

- Ask for a Review:

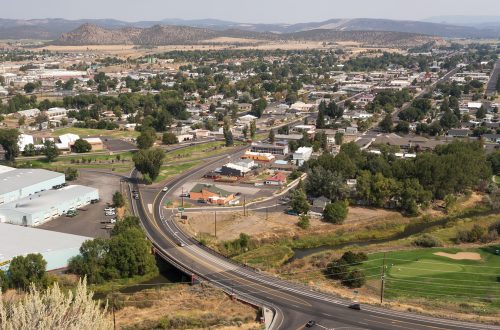

- Contact your Oregon insurance provider and ask for a policy review. Inquire about any discounts you might be missing or if there are ways to lower your premium without sacrificing coverage.

- Consider Usage-Based Insurance:

- Some insurers offer programs that monitor your driving habits, and if you prove to be a safe driver, you could be eligible for lower premiums.

Remember that the cheapest insurance may not always be the best. Consider the reputation and customer service of the insurance provider in addition to the cost. Regularly reassessing your insurance needs and shopping around can help ensure you’re getting the best value for your coverage.

For an affordable car insurance quote, click here or call us at (541) 318-8835.